does instacart take taxes out of your check

Does Instacart take out taxes. There is a 45.

Instacart Driver Pay How Much Does Instacart Pay Shoppers

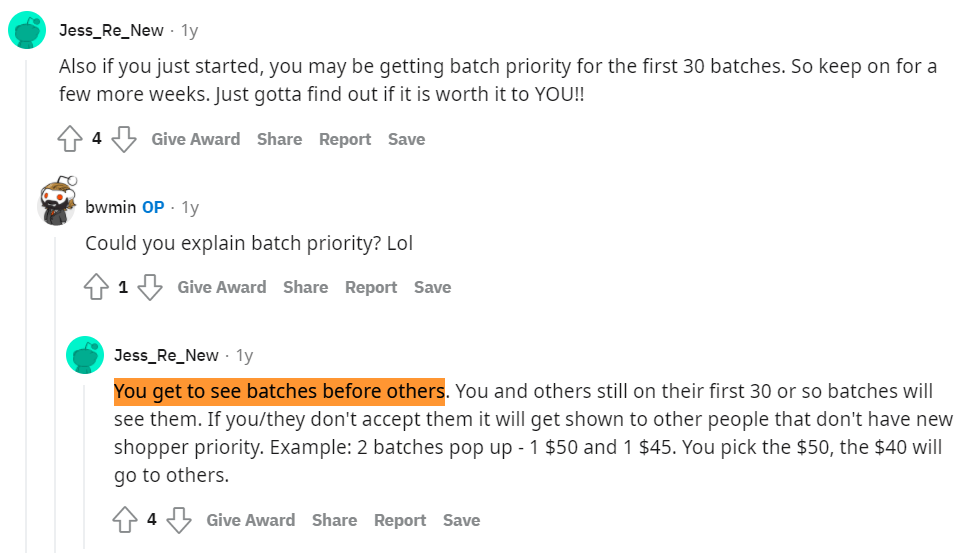

If you are an in store shopper yes if you are a full service shopper no.

. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Instacart does not take out taxes for independent contractors.

The amount they pay is matched by their employer. Get answers to your biggest company questions on Indeed. Yes Instacart takes out tax and it means we can help you manage your tax obligations for you.

Find answers to Do they take out taxes from Instacart employees. Form 1099-NEC is a new name for Form 1099-MISC. There are a few different taxes involved when you place an order.

Heres how it works. Read our full guide to Instacart taxes. Everyone out there serving for.

As for how you combine 1099 with W-2 income the 1099 income goes on line 1 of your Schedule C then after deducting expenses the remaining profit or loss from your Instacart activities. Plan ahead to avoid a surprise tax bill when tax season comes. Download the Instacart app or start shopping online now with Instacart to get.

Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. As an Instacart driver though youre self-employed. You do get to take off.

They will owe both income and self-employment taxes. The IRS establishes the. Instacart sends its independent contractors Form 1099-NEC.

W-2 employees also have to pay FICA taxes to the tune of 765. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. What Taxes Do Instacart Shoppers Need to Pay.

The sales tax may be applied to some or all of the items in your order in accordance with local laws. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

Then you will enter your expenses. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. What tax forms do Instacart shoppers get.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway.

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Doordash Taxes Does Doordash Take Out Taxes How They Work

How Much Do Instacart Shoppers Make Hyrecar

Instacart Help Center Instacart Fees And Taxes

Instacart Reviews 2 071 Reviews Of Instacart Com Sitejabber

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Guide To 1099 Tax Forms For Shipt Shoppers Stripe Help Support

Instacart Driver Review 10k As A Part Time Instacart Shopper

How To Handle Your Instacart 1099 Taxes Like A Pro

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Instacart Mising Information On My Tax Forms Check Yours Youtube

What You Need To Know About Instacart Taxes Net Pay Advance

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Instacart Tax App Tiktok Search

Does Instacart Take Out Taxes In 2022 Full Guide

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

Can You Write Off Mileage For Instacart Zippia